CTFN provides market-leading intelligence on M&A, regulatory developments and other tradeable events across all sectors in the US and Europe.

About Us

CTFN, based in Westport, Connecticut, is a market-leading provider of news and data for financial professionals.

Our core product provides information for active investors, lawyers, dealmakers, regulators and academics seeking granular knowledge around corporate mergers and other tradeable events.

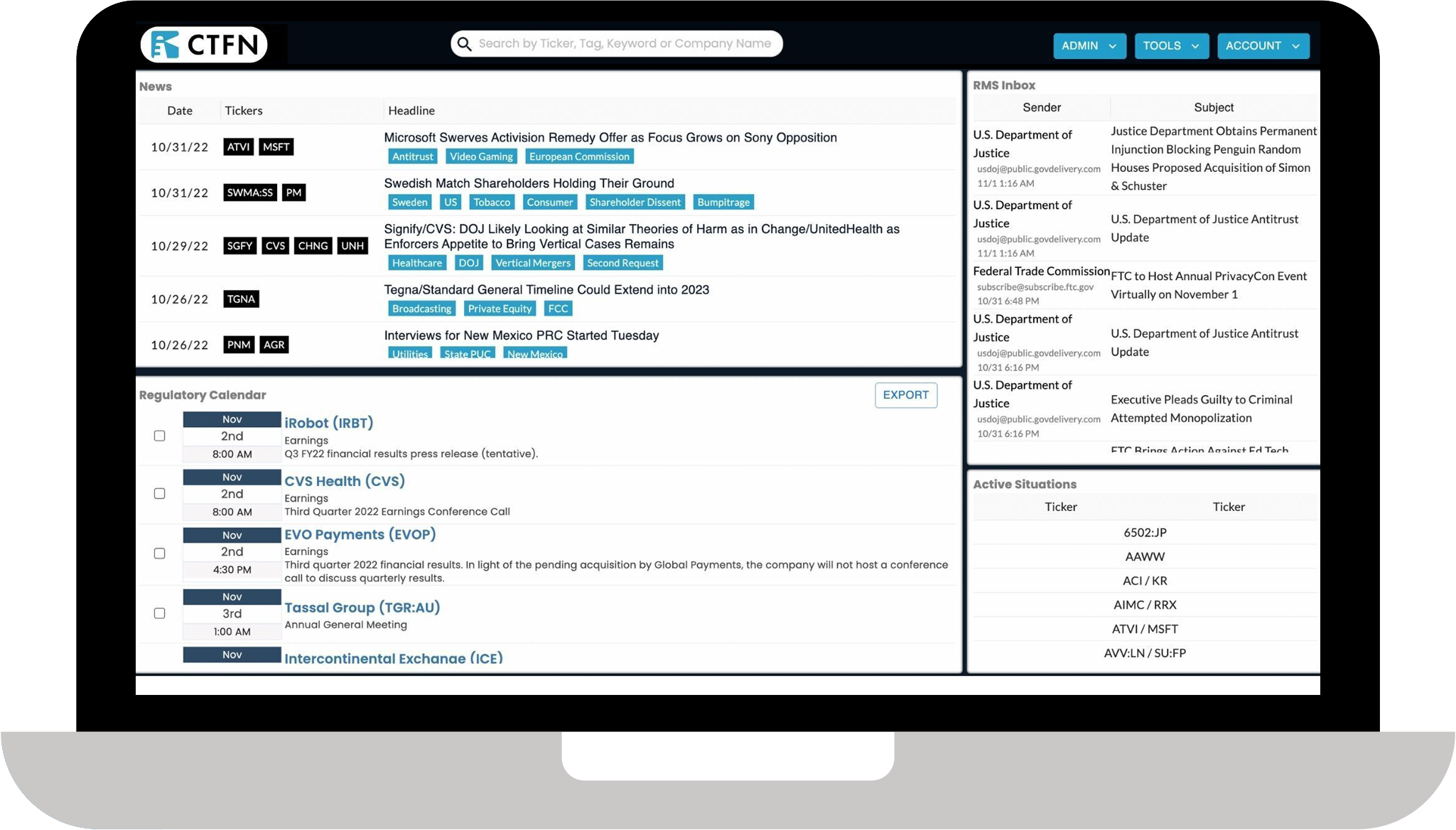

Via our proprietary platform, we deliver financial news, analysis, data and other resources necessary to stay ahead of the market.

Our Products

Via our proprietary platform, we provide news, data and research tools for a sophisticated audience of investors, fund managers, legal professionals, communications firms, corporations and regulators.

M&A and regulatory reporting

CTFN’s reporting service leverages industry intel and sophisticated sourcing from a team of experienced reporters and former investment managers.

Our reporting focuses on M&A, shareholder activism, major disposals and regulatory activity.

All articles can be searched and sorted on our platform.

Daily newsletter

Every weekday, we provide a newsletter covering recent changes in the situations that our analyst team is tracking.

This write-up includes exclusive insights from our team, condensed versions of our articles from the previous day, and summaries of deal announcements, filings and press releases.

Note for sellsiders and retail investors: As well as being available for subscribers to our core product, this newsletter can be read via CTFN Lighthouse.

Direct consultations

Subscribers can schedule time to speak directly with CTFN staff when they have questions about our content. All consultations are chaperoned by our director of compliance.

API

We offer proprietary API feeds on:

- Instantaneous alerts on DMAs filed at the SEC.

- CTFN’s ongoing and historical dataset of news, analysis, filings, tickers and dates.

- An independent data study shows that our signals correlate with volatility and price movements for the stocks mentioned.

Speaker series

We hold live events and webinars to bring our contacts face-to-face with subscribers, providing exclusive insights on deals. Past speakers include:

- Debbie Feinstein, former director of the FTC’s Bureau of Competition

- Stephen Weissman, former deputy director of the FCC’s Bureau of Competition

- Nathan Leamer, FCC staffer and advisor to former chair Ajit Pai

- Francisco Santos Calderón, former vice president of Colombia

State-of-the-art research tools

- DMA alerts: Real-time alerts of all DMAs filed at the SEC. Our platform’s algorithm pulls filings and assigns a score to each agreement, showing its likelihood of being upheld in court.

- Regulatory calendar: A tool tracking events, deadlines and decisions on key deals and regulatory developments.

- Active situations: A way to follow tradeable situations and sort news, court transcripts, filings, releases, dates and announcements.

- RMS inbox: Integrate email subscriptions to sort third-party content on key situations.

Contact Us

Get in touch with us to learn more about our reporting services, request a trial, or share your feedback on our stories. We are always available to assist our readers if the need arises.

Our Offices

55 Post Road West, Westport, CT

1100 15th St., Washington, DC

7 Bell Yard, London WC2A 2JR, UK

Join Us

We are seeking applicants who share our passion for accurate and quality journalism, with a deep respect for their work and their colleagues. Click below to learn more.

CareersCommitment to Our Readers

CTFN is committed to quality journalism. We strive to meet our readers’ needs for accurate and timely information by employing hardworking reporters and analysts who share our core values of integrity and a desire to seek the truth.

We respect the trust our readers place in us to deliver our best work, and in return, we promise a spirit of collaboration and dedication to our craft. We carry that commitment to our employees and our communities by promoting a culture of diversity, inclusion, and mindfulness toward personal growth and sustainability.